Ever find it like attempting to read hieroglyphics with sunglasses on when trying to figure out a home loan? You are not on your alone. Most individuals study loan statistics and wonder, “Wait, why does this interest rate turn into that monthly payment?” A house https://freeloancalculator.com.my can help you avoid sinking into math-induced gloom in this regard.

Actually, purchasing a house is emotional. You are seeing your future kitchen, that outside BBQ arrangement, maybe even a nursery, not only counting numbers. Then you quickly turn back to spreadsheets and forehead creases after looking at the funding section.

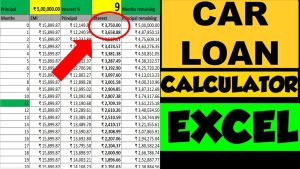

The fix is to enter some figures into a home loan calculator and let the machine perform mental gymnastics. Just mark the blanks: loan amount, interest rate, loan length. And voilità. It spits your monthly payment more quickly than you could say “amortization.”

You may now be thinking, “Cool, I get the monthly money. But just what does that truly mean? Excellent inquiry. The calculator provides a sneak view of how your money will flow over the next 15 to 30 years, not only tells you what you owe every month. See it like looking behind the financial curtain.

Have you ever come across amortization schedules? They are not only attitude-based Excel files. They divide every payment: how much to the principle and how much interest? Interest will reduce over time while principal will rise. Like seeing your debt on a diet.

Here’s a tip: gently vary the interest rate and see how the monthly payment moves like quicksand. A little 0.5% difference will increase your entire payback by hundreds. That is vacation money, second car, or a nice espresso machine you will pretend to use every morning—not pocket cash.

But is it sufficient? I already spoke with the bank. Not quite. Lenders walk you through their calculations. yet a calculator? Your arithmetic is this. No fluff. Not any spin. Only figures. It guides your entry into talks with both feet planted and eyes open.

Would like to play about with loan terms? Do it. Try contrasting loans 30 years versus 15 years. spoiler alert: you bleed less in interest but the 15-year has bigger monthly payments. It’s like deciding between a long hill and a sprint. Depends on your pocketbook and endurance.

Fixed rather than variable rate? Put both possibilities into the calculator. Which one allows you fall asleep at night and which one experiences financial whiplash?

People hardly ever talk about property taxes and insurance sneaking into your monthly payment either. Certain calculators allow you include those. Leverage them. You want to avoid being caught off guard by an extra $400 every month just because the calculator neglected to include it.

Finding out how much house you can afford? Flip the tool. Enter your desired monthly payment and let the calculator reverse. It will let you know which price range won’t let you survive off ramen. Unless, of course, you enjoy Ramen. Not judgement.

And for the overanalyzers: indeed, calculators cannot be fate tellers. Rates change; life throws curveballs; perhaps your employment veers off course. Still, having a strong basis provides you advantage. It like carrying a compass to a labyrinth.

One last point: avoid depending simply on one calculator. Use three. Check again. Like seeking a second opinion before a major haircut. Better safe than hanging with bangs you didn’t request.

Ultimately, Allow the figures to scare you no more. For financial terminology, home loan calculators are like friendly translators. Use them, modify them, stress-test your budget using them. Your future self—living in that house with the killer view and squeaky screen door—will appreciate you.